Spin-Check: Elizabeth Warren’s Wealth Tax / Income Tax Spin

Unless you missed it, WEALTH is different than INCOME.

The goal here is not to wade into the debate about taxation, but to simply call attention to words and statistics. Even though Elizabeth Warren, President Biden, and others are promoting a wealth tax (clear enough), most Americans don’t seem to completely grasp the nuance.

Two BIG spins are in play below:

Words

Numbers

In both instances, a small tweak or reframe of the discussion can mislead one’s conclusions (oh so subtly).

Here are Sen. Warren’s words:

Let’s be clear where we stand on taxes. The 99% in America last year paid about 7.2% of their total wealth in taxes. That top one tenth of one percent where Elon Musk lives, they paid about 3.2%. That’s less than half as much. If Elon Musk were paying at the same rate as the rest of Americans on their wealth, then Elon Musk and his kind could be funding a huge part of what we need in America.” Sen. Warren: Elon Musk is riding on the backs of hard-working families (cnn.com)

It is important to notice that the word ‘wealth’ is distinct from the word ‘income’. Wealth is your totality of net assets (what you own less what you owe), while income in the money you’ve brought in during a year. A wealth tax taxes all you’ve got, while income tax taxes what you’ve added.

The spin here is based on the way the public has understood taxation for generations. When Sen. Warren says that the 1% are paying almost ½ of what the 99% is paying, she is attempting to spin our understanding of income tax into an outrage. It’s not that she’s necessarily wrong (but it would be nice to see her math), it’s that she is talking like the wealthy are cheating the tax code by not paying their taxes.

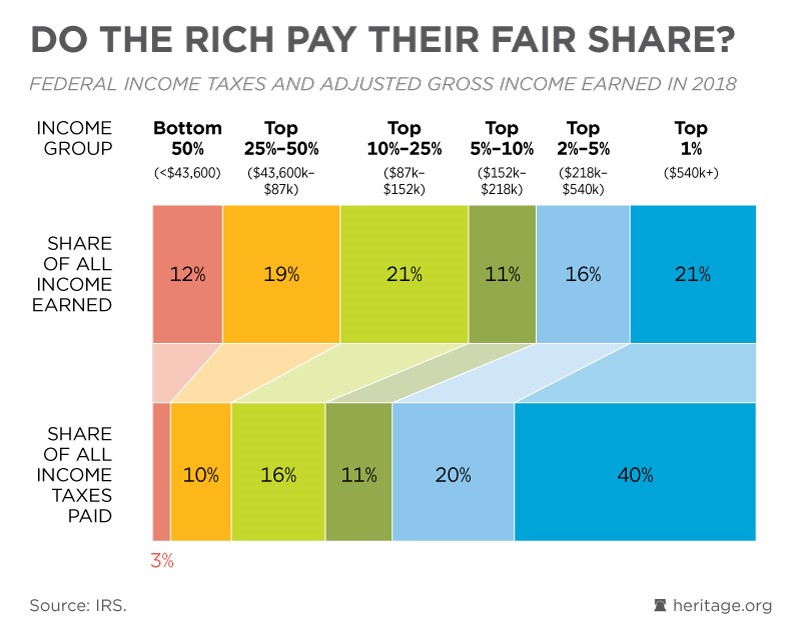

So, if the sentence is changed to ‘income’, then it would read like this: “Let’s be clear where we stand on taxes. The 99% in America last year paid about 7.2% of their total income in taxes.” Of course, that would be patently false as the following displays.

In 1 Chart, How Much the Rich Pay in Taxes | The Heritage Foundation

In actual income taxes paid, the heaviest contribution is made by the wealthiest income earners. In the math of taxes paid compared to income, the lower 50% only pays 3% of all taxes; which means the top 1% is paying of 700% more then the poorest families and a significantly greater percentage than any other group (assuming the math is correct).

There’s more to the spin, but the key lesson is to realize that numbers can often be twisted to say what you want, and even more readily when the words are switch to play against the common understanding.

A wealth tax is different than an income tax, and in principle simply asks us to consider how much we want the federal government to slow our own accumulation of wealth and redistribute it in the a variety of causes (Warren is concerned with multiple universal solutions like universal healthcare, education, etc.

Now you know. Probably smart to keep the following quotes in mind:

“When I use a word,” Humpty Dumpty said in rather a scornful tone, “it means just what I choose it to mean—neither more nor less.”

“The question is,” said Alice, “whether you can make words mean so many different things.”

“The question is,” said Humpty Dumpty, “which is to be master—that’s all.”

-Lewis Carroll: Through the Looking-Glass

There are three kinds of falsehoods, lies, damned lies and statistics.

-Arthur James Balfour

Recent Comments